Calculation and Quotation of Taxes and Fees for China-Nepal Double Clearance and Tax-Inclusive Services

In recent years, the export business from China to Nepal involving double clearance and tax-inclusive services has been increasing. The operational process for small parcel double clearance and tax-inclusive services has become very mature and is currently the mainstream in the China-Nepal market. Cross-border e-commerce logistics, represented by Musa ShipNepal and Yunda International Consolidation, is particularly favored. Large-item double clearance refers to double clearance and tax-inclusive services for single shipments exceeding 300 kilograms. Unlike the certainty and simplicity of small parcel double clearance pricing, large-item double clearance requires more targeted, lower, and more reasonable quotations. In this regard, ShipNepal’s process for handling large-item double clearance and tax-inclusive quotations is more rigorous and precise.

This article takes the example of a Chinese customer shipping insoles, shoes, and soles to Nepal to look at the quotation process of ShipNepal for large items with double clearance.

The quantity of semi-finished shoe products: 3558 kilos

Item images as below:

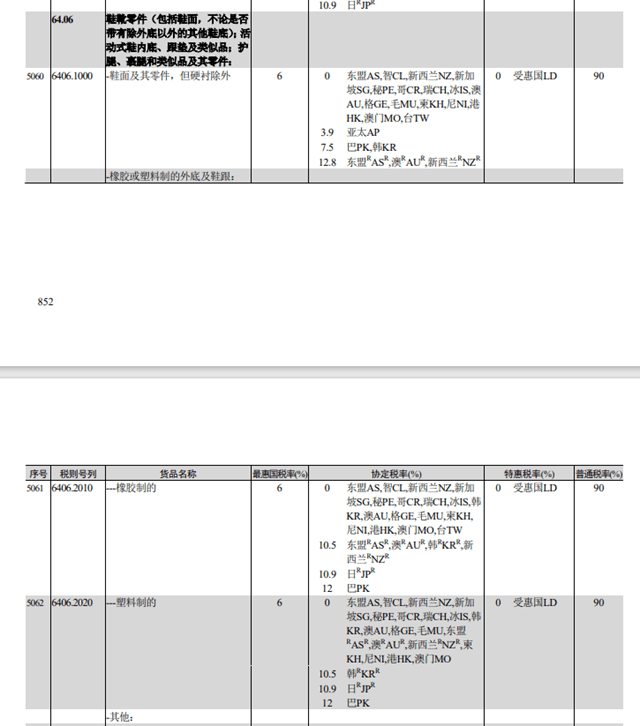

- By clarifying the applicable HS code range for customer goods through the “2024 Import and Export Tariff of the People’s Republic of China,” as shown in the figure below, the HS code range for the goods in the case is confirmed to be 64061000-64069091

- Confirm the English name of the product through the HS Chinese-English comparison table (for the use of customs declaration)

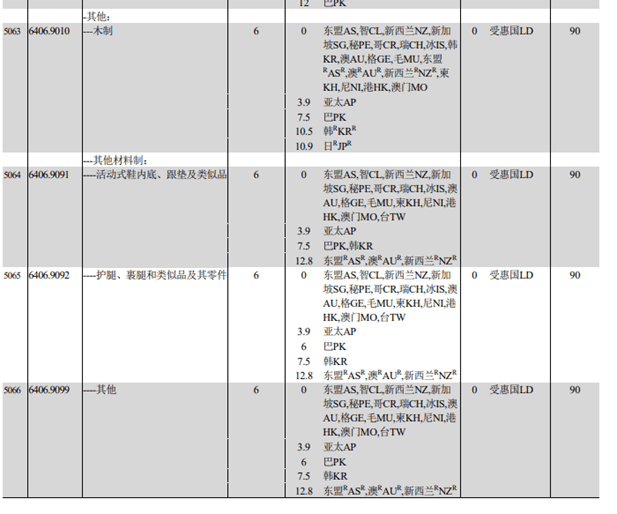

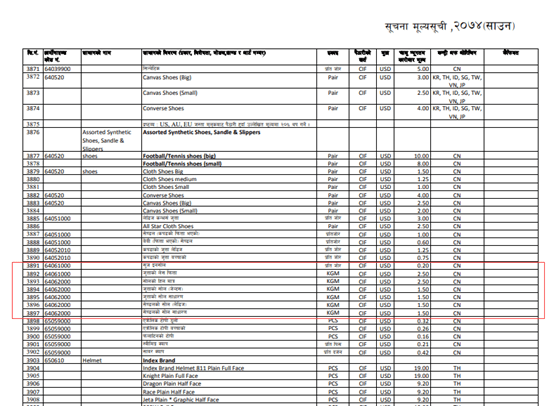

- Based on the above information 1 and 2, further confirm the HS code and applicable tariff rate for the goods in Nepal’s “CUSTOMS TARIFF 2023-2024”. As shown in the figure below, the HS codes for the goods in the case are 64061000 and 64062000, with an applicable tariff rate of 20%, calculated per kilogram or per pair.

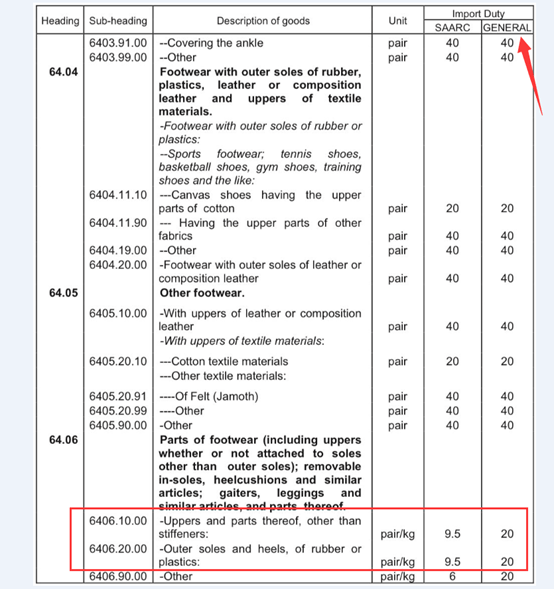

- In the customs valuation documents for imported goods in Nepal, check whether the goods have a minimum customs valuation set by Nepalese customs. If so, use the minimum customs valuation plus 5% as the tax basis. If not, use the CIF price agreed upon with the customer as the tax basis. As shown in the figure below, the example goods have a minimum customs valuation, calculated per kilogram CIF, with the minimum prices as follows: insoles $2, shoelaces and heels $2.5, and various soles $1.5.

- Calculation of taxes (customs duties, value-added taxes)

Customs duty payable: CIF*20%

Value-added tax payable: (CIF+CIF*20%)*13%

Customs duty + value-added tax= CIF*20%+ (CIF+CIF*20%)*13%= CIF*35.8%

In the case, according to the minimum price of the Nepalese customs, an additional 5% is used as the CIF price, and the tax payable is converted into RMB.:

Insole : 0.2*(1+5%)* 7.3 * 35.8% = 0.55 Yuan/kg

heel: 2.5*(1+5%)* 7.3 * 35.8% = 6.86 Yuan/kg

Various soles: 1.5*(1+5%)* 7.3 * 35.8% = 4.12 Yuan/kg

At this point, after the customer confirms the above-mentioned tax quotation, the logistics company (consolidation company) can combine the logistics quotation of different modes of transportation (channels) to report the double-clearance tax-inclusive price of the large item.